The timeline of the taxman is quite short. The Inflation Reduction Act shortened it. They’re coming for all of us in several years or sooner, mush sooner, except for historical numbers.

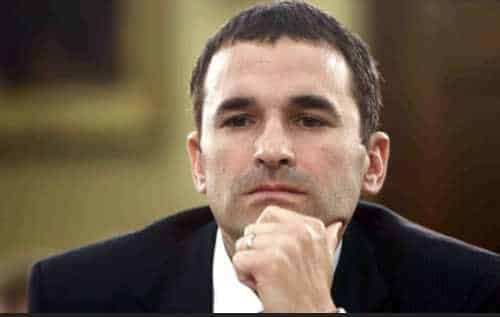

In February, if confirmed as IRS commissioner, Daniel Werfel said he would commit to not increasing tax audits on businesses and households making less than $400,000 per year.

The Inflation Reduction Act — the tax and climate package enacted last summer — earmarked $80 billion for the IRS over the next decade and a half. The money is intended in part to facilitate more audits of corporations and wealthier individuals.

Ahead of the bill’s passage, Treasury Secretary Janet Yellen pledged that there would be no increase in the audit rate for households and small businesses with annual incomes below $400,000 “relative to historical levels.”

Whatever historical levels mean!

In August, the CBO confirmed that the Inflation Act unleashes audits and enforcement on families making less than $400,000.

In September, Werfel said he would pursue equity in audits, which likely means the onus would be on white people.

According to a report by The Washington Times, IRS Commissioner Danny Werfel told Congress on Thursday that taxpayers with incomes under $400,000 won’t have to worry about an increase in their rate of audits for “several years.” For now, he said he’s pouring all of his new audit money into high-income filers.

He also acknowledged that his agency is hiring some armed investigators but said they are a tiny fraction of the overall hiring. He said most of his focus is on audits and customer service.

Mr. Werfel defended his request for $1.8 billion in extra money next year, on top of an $80 billion plus-up the IRS received in last year’s budget-climate bill. That $80 billion will be stretched out over the next decade.

We’re Not Done Yet!

However, NTD reports IRS Commissioner Danny Werfel, under a grilling by the lawmakers on Capitol Hill, hinted that there’s a chance that the agency will—contrary to its repeated pledges—increase tax audits of Americans earning under $400,000.

Mr. Werfel said he had instructed staff at the IRS not to raise audit rates for lower-earning Americans but hinted that there’s some chance this could (inadvertently) happen, and only time will tell.

After Mr. Palmer questioned Mr. Werfel, Rep. Virginia Foxx (R-N.C.) pressed the IRS chief to explicitly guarantee that the IRS wouldn’t raise audits on Americans making less than $400,000.

“That is my marching order to the IRS,” Mr. Werfel replied before adding that “if we fall short of that, I will be held accountable for it,” hinting that, even with the best of intentions, there’s a chance that the IRS might fail to make good on this promise, much like the watchdog has warned.

They need a lot of money for Joe’s big spending!

Subscribe to the Daily Newsletter