As reported by Bloomberg, a study shows that a staggering 80% of U.S. households saw their cash savings drop below pre-pandemic levels.

Millions of Americans are in massive debt as rates soar.

The poorest 40% of households suffered an 8% drop in cash savings, and the middle 40% (the U.S. middle class) also saw their bank deposits and other liquid assets topple. Only the wealthiest 20% of households still enjoy the extra cash they stockpiled during the pandemic, with their savings about 8% above in March 2020.

With many Americans now running low on cash in a time of inflation and sky-high interest rates, some financial analysts believe the U.S. economy could run out of steam, with a possible recession in the cards.

Inflation is still way too high no matter how often Joe Biden and his media say it’s at zero.

Annual increases (November 2022 to November 2023) have been most dramatic among the following indexes, reports Nerd Wallet.

Frozen noncarbonated juices and drinks (+18.6%).

- Food from vending machines and mobile vendors (+14.6%).

- Uncooked beef roasts (+12.5%).

- Uncooked beef steaks (+9.1%).

- Beef and veal (+8.7%).

In 2023, all food prices are predicted to increase by 5.8 percent, with a 5.7 to 5.9 percent prediction interval. Food-at-home prices are predicted to increase by 5.0 percent, with a 4.9 to 5.1 percent prediction interval. Food-away-from-home prices are predicted to increase by 7.1 percent, with a prediction interval of 7.0 to 7.2 percent.

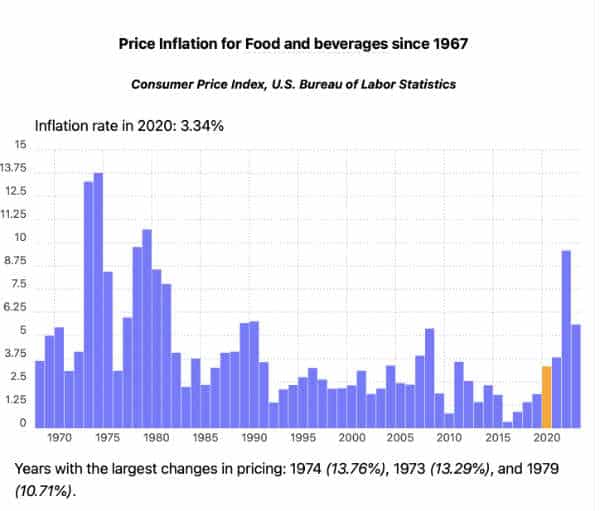

Official data dot org:

Joe Biden and his handlers did this with poor policies, wild spending, heavy regulations, and the war on fuel.

Subscribe to the Daily Newsletter