As we move through the calendar year, inflation looks like it slowed because the percentage is down. However, prices are still going up. Inflation continues unabated.

David Stockman writes: So the talking heads of bubblevision think inflation is abating, but what about this: Federal revenues in November posted at $252 billion—10.3% below last November—while spending came in at $501 billion. And the latter included an ominous +53% rise in Federal debt service costs compared to a year ago.

The Feds are acting as if inflation has slowed and are taking credit for controlling it. They do not have it under control.

The Feds raised interest rates by .5% today. It’s at a 15-year high, and Powell is likely planning higher rates in 2023, slowing the economy. Officials don’t see core inflation coming back down to their target (2%) until 2024. The reality is they won’t make 2%.

The fear is that the Feds are willing to destroy the middle class.

Peter Schiff writes: The salient point is not whether #inflation has peaked (it hasn’t), but the unpleasant reality that inflation will not return to levels anywhere near 2% during the foreseeable future. This is the game changer for the #Fed. Most investors have no clue how to play by the new rules.

Inflation was 6.8% last year and it’s 7.1% this year. That means inflation is up 13.9%. Great job, Joe. All good news, right?

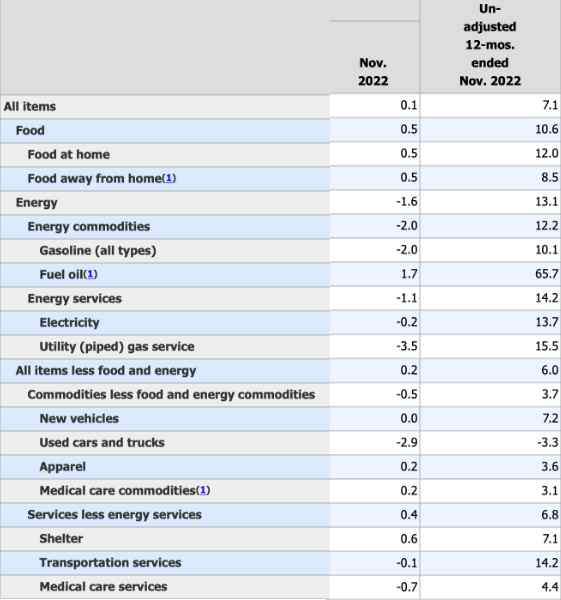

The BLS chart:

Subscribe to the Daily Newsletter