Chinese stocks listed in Hong Kong had their worst day since the global financial crisis, as concerns over Beijing’s close relationship with Russia and renewed regulatory risks sparked panic selling, according to Bloomberg.

The Hang Seng China Enterprises Index closed down 7.2% on Monday, the biggest drop since November 2008. The Hang Sang Tech Index tumbled 11% in its worst decline since the gauge was launched in July 2020, wiping out $2.1 trillion in value since a year-earlier peak.

This follows Russia allegedly asking China for weapons to help them in the war with Ukraine. The US warned the CCP to not do it. The dramatic turnaround started last year after Xi Jinping cracked down on tech firms.

China denied the report but traders are worried about it regardless.

There are other issues.

Tencent Holdings Ltd. is facing a fine for money laundering. Additionally, some Chinese firms wouldn’t open their books to the SEC and they face de-listing.

Also, China could be sanctioned if they help Russia.

According to Bloomberg, “Investors have reason to be jittery after several big-name funds reported significant losses related to Russia. BlackRock Inc.’s funds exposed to Russia have plunged by $17 billion since the war began.”

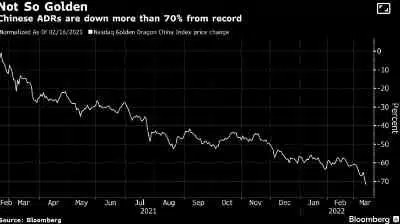

“On Friday, the Golden Dragon Index, which tracks American depository receipts of Chinese firms, slumped 10% for a second consecutive day — something that’s never happened before in its 22-year history. It fell 12% Monday to its lowest level since July 2013. China’s benchmark CSI 300 Index closed 3.1% lower on Monday. The onshore yuan also fell to its weakest in a month as sentiment toward Chinese assets turned sour.”

Subscribe to the Daily Newsletter