The NY Federal Reserve and the Bank of Japan poured money into the financial system. As a result, U.S. equity futures surged Friday morning, reaching the highest increases allowed outside regular trading hours.

The major futures indexes — for the Dow Jones Industrial Average, S&P 500 and Nasdaq — are indicating a gain of 5 percent once regular trading starts.

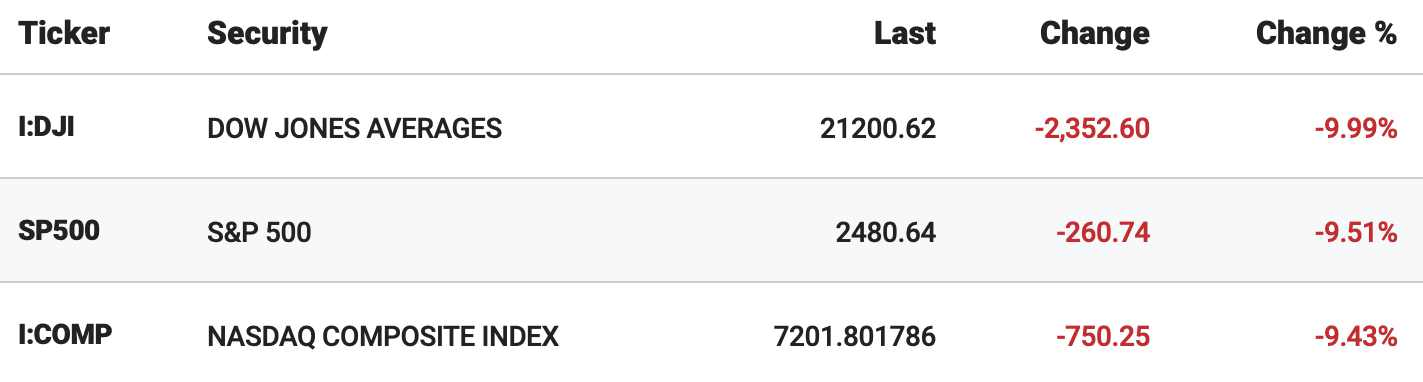

Stocks took a disastrous turn yesterday on the Wuhan Virus terror and the oil war, but today will be very different.

European markets are also rebounding after one of their worst days ever.

London’s FTSE jumped 8.1 percent, Germany’s DAX gained 7.7 percent and France’s CAC added 8.3 percent, Fox Business reports.

Stocks fell so fast on Wall Street at Thursday’s opening bell that they triggered an automatic, 15-minute trading halt for the second time this week. The so-called circuit breakers were first adopted after the 1987 crash, and until this week, hadn’t been tripped since 1997.

The Dow briefly turned upward and halved its losses at one point in the afternoon after the Federal Reserve announced it would step in to ease “highly unusual disruptions” in the Treasury market and pump in at least $1.5 trillion to facilitate trading.

That was temporary and it fell back down.

It would help if the media would stop ginning up the most negative possible outcomes of the Wuhan Virus to destroy the President’s economy.

Subscribe to the Daily Newsletter